The field of medical imaging is currently witnessing significant changes driven by advancements in equipment technology. As devices become more powerful and efficient, incorporating new features and functionalities, the landscape is undergoing a period of evolution. The introduction of new software and artificial intelligence further contributes to this shift, impacting product and service offers, pricing structures, and accessibility.

Key among these changes is the transformation within heavy imaging technologies, including CT, MRI, and PET. These technologies represent substantial areas of expenditure for healthcare systems, encompassing not only acquisition costs but also ‘per image’-costs, equipment maintenance, and the expertise required for radiologist interpretation.

In light of these developments, it becomes crucial to explore the current and future state of the market. Understanding the complexities of equipment tenders and the background of healthcare system funding policies is essential to navigate this dynamic landscape. Join us as we explore in-depth insights from European tender notices and MedTech tender awards in the Diagnostic Imaging sector spanning the years 2020 to 2023.

Tender Activity and Notices

Understanding the dynamics of tender activity in the diagnostic imaging sector requires an exploration of existing equipment levels and purchasing motivations. The pivotal question revolves around whether tenders aim to replace current equipment or to bridge gaps in equipment provision. Across European Union (EU) countries, the amount of imaging equipment varies significantly. For instance, the presence of over 40 CT scanners per 1 million inhabitants in Greece, Denmark, and Bulgaria contrasts sharply with the fewer than 17 per 1 million in the Netherlands and Hungary. Notably, countries with a high presence of non-hospital imaging centers may purchase without engaging in public procurement.

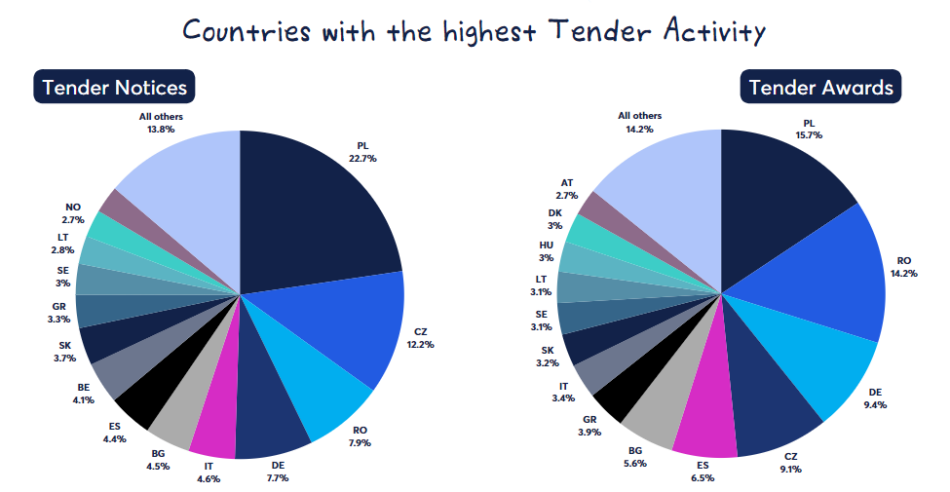

The landscape of who purchases within this dynamic environment is closely tied to healthcare system characteristics. A case in point is Poland, characterized by a highly regionalized healthcare system, showcasing significant tender activity. Leading markets like France demonstrate a distinctive pattern where substantial spending is driven by group purchasing organizations like UniHA which can set up large volume-tenders, including for major equipment, to serve multiple academic hospitals. Similar trends are observed beyond France, showcasing the impact of group and joint purchasing in Nordic markets. This is highlighted by recent tenders for CT scanners.

France ranks 1st in total spending for tender awards, comprising approximately 20% of the overall expenditure, despite being in the 18th position based on tender activity. Similarly, in terms of total spending for tender notices, France claims the top spot, accounting for around 24% of the total spend, even though it holds the 16th position in the ranking based on tender activity.

The Rise of MEAT Criteria

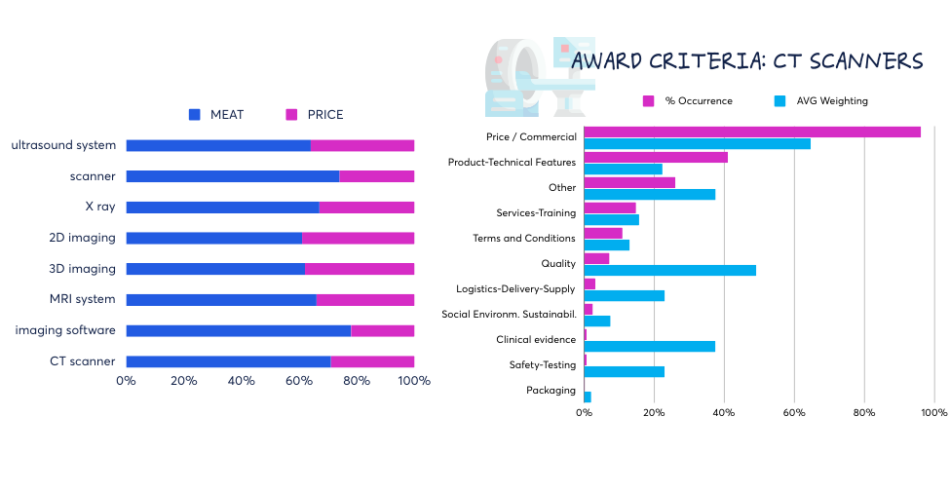

Understanding the factors behind the increase in Most Economically Advantageous Tender Awards (MEAT) involves recognizing the key elements driving both MEAT and overall competitiveness. Beyond the apparent focus on product features and commercial aspects, prominence is given to maintenance contracts and additional services, especially when dealing with high-cost equipment. These considerations have transitioned into critical tools for achieving competitive success, extending beyond the context of tender processes.

As the industry adopts more sophisticated devices, software, and faces interoperability challenges, training and education emerge as increasingly relevant factors in award criteria. The significance of these aspects is underscored by their role in ensuring the effective utilization and seamless integration of advanced technologies. For new entrants in the market, establishing confidence in long-term technical support and service provision becomes quite a challenge in the fiercely competitive arena.

Year Over Year Comparison

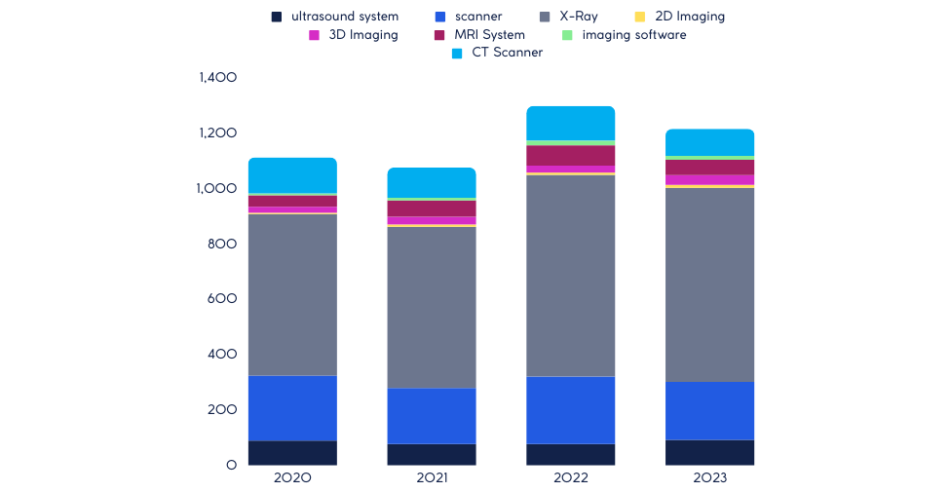

A critical facet of understanding the trajectory of the diagnostic imaging sector involves a year-over-year comparison, shedding light on evolving trends and emerging patterns. In recent years, the field has demonstrated stability in tender activity, but change is undoubtedly on the horizon. A key factor that could lead to significant changes in the diagnostic imaging sector is the integration of Artificial Intelligence (AI) in diagnostic imaging. Despite imaging software tenders currently being relatively modest in number, there is an obvious upward trend, particularly as national screening programs scale up their use of AI software. Questions remain on the potential standardization of software within equipment services packages and the dual impact of AI: will it reduce the imperative for additional capital equipment, or will it drive higher imaging demands by enhancing diagnostic accuracy?

Policy and Reimbursement Driving Demand

Policy and reimbursement significantly influence imaging equipment demand and healthcare initiatives.

Healthcare systems are increasingly looking to generate savings through advanced, improved and earlier diagnostic practice. Notable initiatives, such as the EU Beating Cancer Plan, are propelling a rise in demand for specialized screenings like mammograms and lung CT scans. With advances in personalized medicine, enhanced diagnostic modalities gain increased relevance. Routine reimbursement for screening and early diagnosis is becoming increasingly important, potentially driving demand in the future as healthcare systems adapt to changing standards of care.

Content developed through collaborative discussions with our partner, Henrike Granzow, from Apersy Consulting, exploring European MedTech Tender Awards & Notices in the Diagnostic Imaging Sector.

Download Your Exclusive PDF Now!

Thank you for exploring our in-depth insights on MedTech Tender Awards & Notices in the Diagnostic Imaging Sector.

Access these detailed insights anytime by downloading our comprehensive PDF and dive deep into the trends that shape the Diagnostic Imaging landscape.

21/03/2024

21/03/2024